Is There An App That Post Mates Drivers Use For Tax Purposes To Check Miles

If you drive as an independent contractor for food delivery apps like Doordash, Uber Eats, Grubhub, Instacart, or rideshare companies like Uber and Lyft and so many others, tracking miles makes a HUGE difference in your tax bill.

If you don't track them, you cannot claim them.

A lot of food delivery drivers are putting in thousands, or tens of thousands of miles per year on their cars for delivery. At the 56 cents per mile standard mileage deduction (2021), those miles add up to huge tax deductions. If you're not tracking your mileage, you're costing yourself a lot of money.

Here's one other warning: If you aren't tracking but go ahead and make up a number, that can cost you even more. If the IRS ever looks into it and you don't have documentation, it'll cost you a lot more than just the mileage deduction.

You need to understand what's required for tracking. Make sure you have the right documentation.

And track your miles.

We'll look at the following in this article:

- Should I track miles if I'm only taking the standard deduction (and not itemizing)?

- What does the IRS require of a mileage record?

- Using a written mileage log vs a GPS app

- What a good written record looks like

- What to look for in a good GPS mileage tracking app

- What I do personally to track miles

- What miles can you track and claim as a business expense?

Do I need to track miles if I don't drive enough to itemize my deductions?

Let me put it this way: if you don't, you're costing yourself money.

But you should. Because we are self employed workers, we deduct miles somewhere else. The good news is you can take the standard deduction AND still claim your miles.

Don't listen to anyone who says otherwise.

They're wrong.

By the way: Don't ask for tax advice on Facebook or Reddit. Just don't do it.

Now that we have that out of the way, let's talk about tracking miles.

What kind of tracking does the IRS require of delivery and rideshare drivers?

The IRS requires a written record four specific things of your record.

- The date. This means you need a written record for every single day that you have business miles. You cannot lump several days together.

- A general description of where you went.

- How many miles you went.

- The business purpose of your trip.

On top of this, you need a record of the total miles driven for the year. This is best handled by taking an odometer reading at the start of the year (or when you obtain that vehicle) and at the end of the year.

This means a couple of things:

First off, this means you have to have a record. You can not estimate.

It also means you can not just say that since you drive your car 100% for business purposes, all you have to know is your total miles for the year. The IRS states you need a daily comprehensive mileage log.

This also means you cannot rely on some email from Grubhub or Doordash saying they estimate you need so many miles. Again, you need a daily total to be compliant, and a simple email won't cut it.

What is the best way to track miles as a delivery driver for Grubhub Doordash Uber Eats, Postmates or other gig apps?

Is it better to use a GPS app or keep a hand written record?

I think either one can be good. There are benefits to both and I personally do both.

A written record with Odometer readings is the primary way I track.

On top of that, I have a GPS record that shows where I traveled. It serves as a backup. It also provides nice documentation in case a customer lies and says they didn't get their food.

Advantage of a written record.

I have heard rumors that IRS auditors tend to be old school and trust the written record more than GPS records. I have no idea if that's true, and there are aspects of the GPS record that seem more reliable.

It may be that a reason that a written record might be preferred is that the odometer reading lends credibility. You can cross reference your odometer readings with maintenance records to show that you're not inflating numbers. If you are making up miles as you go along, you end up claiming more miles than you actually put on your car. A good auditor can sniff that kind of thing out.

With a GPS, it's far too easy to let it record when you are a passenger, taking an Uber, or using public transportation. You might have a GPS record but you cannot demonstrate that all those miles were used on your particular vehicle.

The regular task of recording odometer readings demonstrates an attention to detail. That also lends some credibility.

Disadvantage of a written record.

There are two major potential problems when you rely on your written record.

What happens if you forget to record your odometer reading?

What happens if you lose your written record?

There are actually measures in place where you can go back and recover mileage records if you forget to track your miles. If you have other evidence supporting the miles you drove, you can legally update your business mileage record accordingly.

In fact, it's probably easier to do that with a written record than if you forget to turn on your GPS tracker, because your odometer readings from the previous day give you a point of reference.

Personally, I use Google Sheets for my written record. My record is stored in the cloud. I can access it on my phone and I can access it on my home computer. I have a shortcut on the home screen of my phone. That keeps me from losing that written record.

Advantage of a GPS app.

The biggest advantage with a GPS app is that it provides more detail. Of course, to have that detail, you want to use an app that shows the route you took. Many popular programs only show you a start and end point.

If you have the right kind of tracker, you can look at the record and see exactly where you were. That goes above and beyond on the IRS requirement of identifying where you went.

Some trackers will automatically start and stop recording based on when you start driving. If you're hesitant to use a written record because you're afraid you will forget to record your miles, you want to get an app with this feature.

Of the apps that I know, automatic mileage tracking is only available on the paid versions. But think of it this way: Forgetting to record your miles for one or more days of delivery could cost you far more in additional tax liability than the cost of an automatic tracking app.

Disadvantages of the GPS app.

There are two major issues using a GPS app.

The first one is something I mentioned earlier. It's too easy for the app to record miles when it shouldn't be. It can record times you're walking or when you're travelling in another vehicle. This is a credibility problem.

Perhaps the biggest issue is accuracy. I know, sounds weird to say that. How can you get more accurate than an actual recording of where you went.

I did a comparison of several popular mileage tracking apps and how they work for those of us doing delivery. One thing I noticed was that compared to baseline odometer readings, the apps did not track as many miles. Some were off by 10% or more.

This has been a full-time gig for me, and I've put on more than 30,000 miles in a year. 10% of that would mean 3,000 miles I can't claim. At 56 cents per mile (2021), that 10% inaccuracy means I pay taxes on $1,680 of taxes that I shouldn't be paying taxes on. That translates to $400 to $500 extra on my tax return.

Even if this is just a side hustle for you, missing ten percent of your miles is a great way to pay more at tax season than you should.

A lot of gps apps would lag before they actually started recording. A lot of the food delivery apps already tax the limits of your phone and mileage apps make it worse. That can block the phone from recording.

Sometimes the apps shut down or fail to record.

And of course, there are the times you forget to start recording.

What would a good written record look like?

You can make it as simple or as complicated as you like.

The simplest way is take a notepad and draw six or maybe seven columns. Use these headings:

Date

Starting Odometer Reading (Start for short)

Ending Odometer Reading (End for short)

Total Miles

Destination

Business Purpose

(this is optional but good for documentation) Note. The note column is just to add any explanation you think might be necessary for a particular trip.

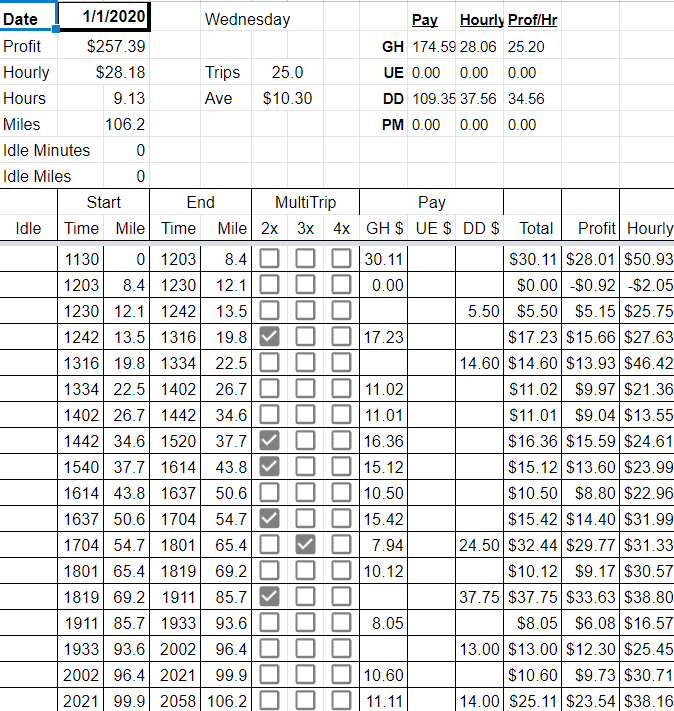

I mentioned that I use a Google Sheets spreadsheet. I do mostly the same thing on that. In my situation I use the spreadsheet to also list my earnings for each company (which adds further documentation to show my business purpose).

Below is a sample spreadsheet.

Remember the four things the IRS requires? The date is in column A, Miles total is column D, Where I went is in column E and the business purpose is column F. It meets all four requirements.

What is the best type of GPS app?

In this article, I looked at seven different mileage tracking apps to try to figure out the best mileage tracker app.

Some were free, some had a cost to use. Some would track automatically. I mentioned some of the accuracy issues above, and those issues seemed worst with the automatic tracking.

Here's what you want to look for:

- The app must be able to provide a written report that meets the IRS requirements.

- It needs to record the four essential elements we listed above.

- It needs to provide a downloadable or printable IRS-compliant report

I HIGHLY recommend that you get an app that shows the path that you drove. Some apps only show a starting point and an end point. The problem with that is that on delivery you can often have the same start and end point, a lot of miles, and nothing that seems to back those miles up. It just looks odd.

Choose an app style that works for you. With one exception that I found, the manual tracking apps were more accurate because they didn't have the start lag that the automatic tracking apps had. However, that's only true if you're really good at remembering to start and stop your tracking.

In my evaluation, Triplog was easily the most accurate. The best thing about Triplog is an innovative idea that solved the accuracy issue that other automatic trackers had. Triplog will record any time your delivery apps are active. They also had some options to tap into what's happening with your car or to use an external device to track mileage (thus reducing demand on your phone).

Here's a brief rundown of the mileage tracking apps that I looked at.

Triplog.

Triplog was in my evaluation the best app and most accurate for pure mileage tracking. It has a paid version that has automatic tracking with unlimited tracking. There's a free version that has manual tracking and limits you to 40 trip records.

Of all the tracking apps, Triplog was the only one that would let me see what the time was at given points along the route. This is a huge feature in my opinion, because it allows you to document exactly when you were at a customer's or at a restaurant. This can make a difference when a customer claims they didn't get the food.

Triplog has a good income and expense tracking feature as well. This makes it a well rounded app.

Hurdlr.

In my comparison article, Hurdlr ranked slightly over Triplog as an overall app on the strength of its tax calculator and its bookkeeping features. I like the user interface a little better on Hurdlr than any of the other apps.

The free version of Hurdlr is by far the best free mileage tracker app that I've seen. With the free version of Hurdlr, there is no limit to how many trips it will track. This makes it preferable to the free version of Triplog in my opinion.

The paid version includes an auto tracking feature that is second only to Triplog, in my opinion. It does have a slight lag in when it starts recording and that impacts accuracy. Hurdlr is the most sensitive about its stop and start points, so it will show more trips in a given day. In my opinion that's a good thing because it's more likely to start and stop a session when you are at the restaurant or at the customer's.

Everlance.

Everlance provides a good overall product that also has good expense and income tracking features. I did run into times where the auto tracking did not kick in, thus losing a lot of miles. It seems like battery saving mode on my phone was more likely to cause problems on Everlance.

Everlance does provide a route map showing where you went. The free and paid versions both have automatic tracking, but the free version only gives you 30 trips. Because of all the starting and stopping that goes with deliveries, I used my 30 trips up within three days.

Gridwise and Stride Tax

These are two free mileage trackers that require you to manually start and stop tracking. I list them together because of the similarity in how they work from a tracking standpoint. Both will provide a map showing the route you drove. Both require you to manually start and stop your tracking for each trip. They both have extremely limited expense tracking functions and neither has an online portal you can log into.

I do believe Gridwise goes a little beyond Stride in that they have a feature that can automatically keep track of your earnings by pulling your earnings report from each food delivery service or rideshare app. It gives you some analytics to help you see how you are doing overall. At the same time, you need a paid version of Gridwise in order to export a sortable expense record, something that's standard with the free Stride program.

Quickbooks Self Employed

Quickbooks Self Employed is actually a bookkeeping program designed for self employed individuals. After the promotional period, the cost is $15 per month with no free option. They added a mileage tracking app to integrate with their program. The mileage tracking is automatic. Quickbooks Self Employed does not provide a route detail, only a starting and ending point of your trip.

MileIQ

MileIQ does allow you to keep track of your mileage on up to 40 trips per month for free. For typical delivery days for me, that comes out to about 4 days worth. The paid version does allow unlimited tracking. Like Quickbooks Self Employed, it does not provide a map of the route that you took, only a starting and finishing point.

The Triple Whammy (This is what I do).

My primary tracking method is a Google Sheets spreadsheet. Mine is pretty extensive – for each day I have starting and finishing odometer readings, total miles, an earnings breakdown of each delivery app, the number of miles I drove, and a list of statistics (profit per hour, trips per hour, etc).

It doesn't stop there. I actually have two other records for each day.

I have a GPS record of my trips. In fact, if you have Google maps, you may have one as well.

For awhile, I was running Stride along with my manual record. Stride was my backup, giving a visual record of my trip.

Then I realized that the timeline feature in Google Maps was already doing this for me. It shows where I've been with my phone, for just about any time for the past couple of years. It's a little creepy when you think about it.

I don't recommend you use this for your overall tracking, as Google Maps doesn't update location nearly as frequently as any of the apps mentioned. You'll lose a lot of miles if you do. That said, it's a fantastic backup.

The third record is another spreadsheet I keep. This is the nerd in me.

I started tracking every delivery. It wasn't for tracking purposes, but for analytics. I enter the miles and time for each delivery, and it allows me to see how profitable I was for each delivery, each delivery company, and even for certain times of the day.

I keep this on Google Sheets, and it gives me a great view of how my day is going. If it ever comes down to an audit, I have even further backup of my miles.

Track your miles.

You have to do it. If you do not have a good record of your miles and the IRS audits you, they will disallow any of your deductions. I drove about 20,000 miles last year, and not tracking miles would have added about $3,000 I'd have to pay come tax time.

Okay, but what if you don't claim the 56 cents per mile (2021)? What if you choose to claim actual expenses with all your fuel costs, oil changes, insurance, depreciation and so on?

You still have to track those miles. You can only claim the business use percent of those expenses. If 80% of the miles you drove were business, you can claim 80% of the actual expenses.

Which ever method you choose, you have to check off on your Schedule C tax forms that you have a written record.

As a delivery driver who is an independent contractor, whether for Grubhub or Doordash, Uber Eats or others, or as an Uber driver or Lyft driver, you have to keep a record of your miles.

You don't have to go triple overboard like I do (though it's a good way to make sure you don't lose out on too much money in deductions). If you want something that's going to do it automatically for you, think about using Triplog. You can try it free or get 20% off using my referral link.

If you choose to record manually, make sure you're not forgetting to write everything down. If you use a GPS app, always double check to make sure it has been recording.

Whatever works best for you: Track. Your. Miles!!!

What miles should I track?

Hopefully you're getting an idea together of what might work best for you on how to track your miles.

Now of course the question comes up: Exactly what miles should I be tracking for my delivery or rideshare driving?

The simple answer is whatever miles you have to drive to perform your business. The IRS has a rule for claiming business expenses, which is that an expense must be necessary and reasonable for the operation of your business. Does it help you accomplish a business purpose?

A lot of drivers don't claim enough miles. Some will claim too many. There's a lot more that goes into figuring out what miles you should track as we continue on.

The Delivery Driver's Tax Information Series

- Introducing the tax guide for Grubhub, Uber Eats, Doordash, Instacart and other gig economy contractors

- Independent contractor taxes 101: What you are taxed on.

- What your real income is for gig economy contractors

- Understanding your 1099 forms (Doordash, Uber Eats, Grubhub, Instacart etc).

- What to do if your 1099 is incorrect or doesn't arrive

- Understanding business-related expenses for gig economy independent contractors

- Deducting your car expenses

- How to track miles as an independent contractor

- What miles can you claim when driving for Doordash, Uber Eats, Grubhub, Instacart etc?

- What if you forgot to track your miles?

- Is it better to claim actual expenses or miles?

- Three special car expenses you can claim even when claiming mileage

- What non car expenses can gig economy independent contractors claim?

- How do you claim expenses for using your bicycle, e-bike, motorcycle or scooter?

- Deducting your car expenses

- How to file taxes for Uber Eats, Grubhub, Instacart, Doordash, Lyft etc.

- How to fill out your Schedule C

- Understanding Self Employment tax

- Four special tax deductions for self employed independent contractors

- Filling out your income tax form 1040 for Grubhub, Instacart, Doordash, Uber Eats contractors

- How to save for next year's taxes

Prep Time 1 minute

Active Time 1 minute

Additional Time 1 minute

Total Time 3 minutes

Instructions

- Understand the four things the IRS Requires. If you want to claim your vehicle expenses, you need a written record that includes the date of the trip, where you went, how many miles you drove, and the business purpose of your trip.

- Understand the advantages of a written record. A written mileage log is often more reliable and more widely accepted.

- Understand the advantages of using a GPS app like Hurdlr or Triplog. If you're prone to forget to write down miles, maybe a GPS that automatically records your trips is better for you.

- Decide on a method and start tracking. Yesterday.

Notes

You can claim your miles, even if you take the standard deduction. But you can only claim them if you have documentation. This article goes into more detail about how you can document those miles.

Is There An App That Post Mates Drivers Use For Tax Purposes To Check Miles

Source: https://entrecourier.com/delivery/delivery-contractor-taxes/mileage-and-car-expense/how-do-i-track-miles-for-grubhub-doordash-postmates-uber-eats/

Posted by: parkerbary1954.blogspot.com

0 Response to "Is There An App That Post Mates Drivers Use For Tax Purposes To Check Miles"

Post a Comment